In How to Build an Economy for the 99%, Wendy Keats recommends five key strategies based on two important criteria: 1) they have been tried-and-proven, more than once, to help build more inclusive, sustainable economies; and 2) they can’t cost taxpayers one more cent than we pay now.

In this strategy, she covers the sheer absurdity of our current banking and financial models and questions why our governments borrow for public infrastructure and other public programs from big banks and foreign corporations at exhorbitant interest rates when we already have locally-owned, tried-and-proven options like the Public Bank of Canada and credit unions.

Okay, back to common sense. Last year, Canada’s six largest banks dished out $15 billion in bonuses, not including stock options for CEOs with special tax privileges. And apparently this wasn’t enough. According to Bill Vlaad, whose company monitors bank compensation trends, “Bonuses themselves were some of the bleakest in almost a decade. Financial professionals should count their blessings that it wasn’t worse. It could very well have been a bloodbath and a much more aggressively negative environment.”

In 2016, Canada’s five biggest banks — BMO, CIBC, RBC, Scotiabank and TD — were ranked the country’s most profitable companies, collectively booking $44.1 billion in pre-tax profit. That same year, they avoided paying $5.5 billion in taxes.

According to Statistics Canada, between 2010-2015, pre-tax profits in the banking sector as a whole soared by 60% while their tax rate dropped by almost the same amount, resulting in Canada’s big banks paying the lowest corporate tax rate in the G7, and only one-third of that paid by other Canadian businesses.

As the profits of big banks have soared, they have systematically shut down branches in small and rural communities, leaving tens of thousands of people without services. They also decline banking services to many low-income and marginalized people and this has resulted in almost two million Canadians paying the exorbitant interest rates charged by payday loan operators.

“Private financing could add $150 billion or more in additional financing costs on the $140 billion of anticipated investments, amounting to about $4,000 per Canadian.”

But big banks don’t just lend to individuals and businesses. They lend billions of dollars to our governments for public and infrastructure projects.

Beginning in the mid-1970s, Canada stopped borrowing, (interest-free) from its own Bank of Canada and switched to private banks. Since then, Canadians have paid them over $1 trillion dollars in interest — nearly twice the debt itself.

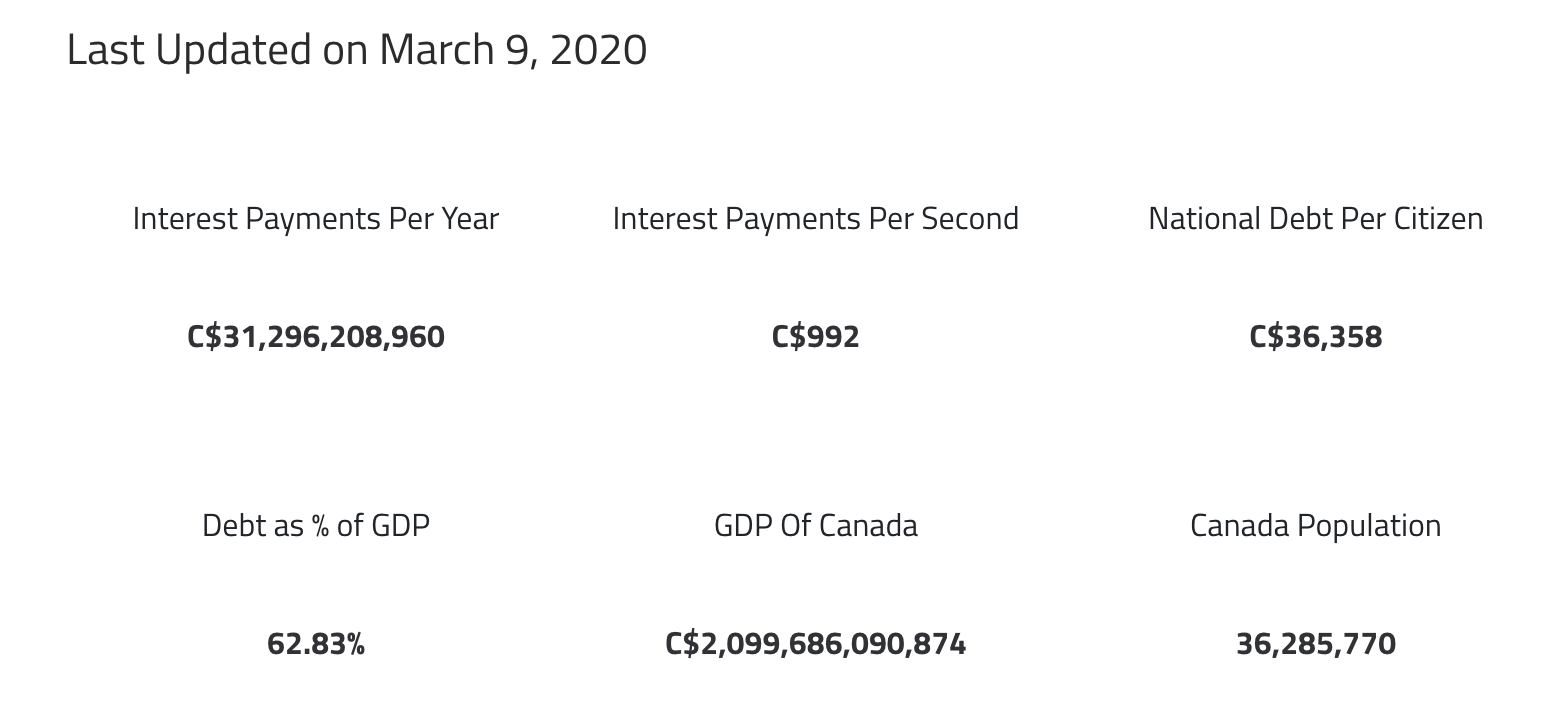

In 1962, our national debt was $18 billion. Since then, it has risen by 380% to nearly $686 billion. As of March 2020, Canada pays nearly $1000 per second in interest every day - and this doesn’t include the interest on our provincial debts.

Tried-and-proven models

Public Banks

Public banks are mandated to serve a public mission and operated for the good of the public. They are owned and governed by the people through their municipal, provincial or federal government and can fund projects at reduced costs. They make below-market loans to governments for public and infrastructure projects, saving them millions of dollars, and creating low-cost credit for communities to grow and innovate.

Research by bank scholar Thomas Marois shows there are nearly 700 public banks around the world with combined assets near $38 trillion — about 48% of global GDP. That means 20% of all bank assets are publicly owned and controlled.

Since 2010, nearly half of U.S. states have introduced legislation to create public banks in an attempt to regain control over regional economies after Wall Street destroyed much of the economy and was bailed out at the public’s expense.

There is also much to learn from the German saving banks, or Sparkassen. The assets of these 400 local saving banks are nobody’s property. They are independent of local authorities, which means that they cannot be privatized or have their profits diverted for other purposes.

And here’s the kicker. Canada already HAS a public bank! Our governments just don’t use it. Instead, they borrow money for public and infrastructure projects from private banks who charge us exhorbitant interest rates.

Huh?

The Bank of Canada

In 1938, the Bank of Canada was established as a publicly owned financial institution with a mandate to lend money to federal and provincial governments. It helped bring our country out of the Great Depression by injecting debt-free money into various infrastructure projects. During World War II, it financed the creation of the world’s third largest navy, established Canada as a leader in aircraft manufacturing, and provided education benefits and subsidized farmland for veterans. As a result, Canada emerged from the war with significant infrastructure in place and very little debt.

Over the next 30 years, the Bank of Canada continued to transform our economy by financing large public projects such as the Trans-Canada highway, St. Lawrence Seaway, airports, subway systems, old age pensions, family allowances, universal Medicare, nation-wide hospitals, universities, research facilities and more. All this was done by borrowing interest-free money from our own public bank.

Then came 1974 and everything changed

“The influence of financial capitalism was based on the assumption that politicians were too weak and too subject to temporary popular pressures to be trusted with control of the money system. [International bankers felt] it was necessary to conceal, or even to mislead, both governments and people about the nature of money and its methods of operation.”

As I described in Becoming the Society We Want, the mid-1970s was the era during which Milton Friedman’s neoliberal capitalist model began to dominate world economics. Governments, including Canada, began transferring the control of our economy from the public to the private sector. They did this by eliminating price controls, deregulating capital markets, lowering trade barriers, using privatization and austerity measures.

And by changing our banking systems.

In 1974, the international Basel Committee was established by the Group of Ten countries of the Bank for International Settlements (BIS), which included Canada. Its stated purpose was to “maintain monetary and financial stability”.

To achieve that goal, the BIS discouraged nations from borrowing interest-free from their own public banks and instead get their financing for public and infrastructure projects privately-owned banks that charge interest.

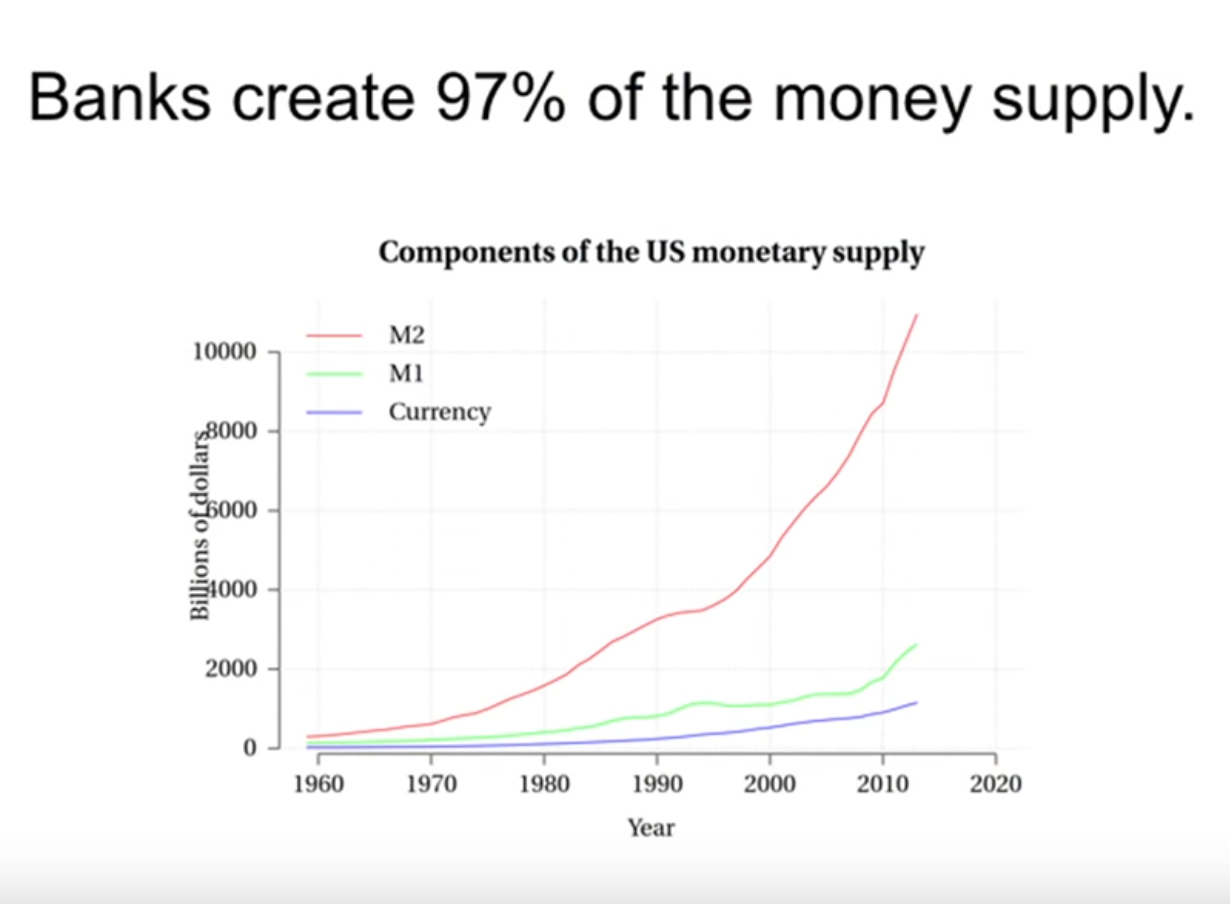

Why, you ask? Well, they said it was because public banks could create their own money and this would inflate money supply and prices. What they failed to mention (actually, what they deliberately hid) was the fact that private banks were doing exactly the same thing!

Yet for reasons that I personally can’t wrap my head around - and that many would say were based on nothing but greed, power, and politics - Canada signed onto this bizarre proposal.

In 1974, it stopped borrowing interest-free money from the Bank of Canada and starting financing our public and infrastructure projects through private banks.

By 1981, Canada’s interest rate had risen to 22%, effectively doubling our debt in less than four years

Canadians have now paid over a trillion dollars in interest — nearly twice the debt itself.

If Canada had been borrowing from its own bank all along, it could be not only debt-free but sporting a hefty budget surplus today.

In 2007-2008, our combined federal and provincial debt was $837 billion. For 2019-2020, it had (pre-COVID) been projected at $1.5 trillion, equaling 64.3% of our entire economy, or $39,483 for every single Canadian, and its growing by the minute. The federal debt alone has increased by 50% in just the past ten years and now costs us over $3 million every day to service.

In December 2011, a lawsuit was filed in the Canadian federal court aimed at forcing the government to restore the use of the Bank of Canada to its original purpose of making interest free loans to municipal, provincial and federal governments for ‘human capital’ expenditures (education, health, and other social services) and infrastructure projects.

“The plaintiffs stated that since 1974, the Bank of Canada and Canada’s monetary and financial policy have been dictated by private foreign banks and financial interests led by the BIS, the Financial Stability Forum (FSF) and the International Monetary Fund (IMF), bypassing the sovereign rule of Canada through its Parliament.

Today this silent coup has been so well obscured that governments and gamers alike are convinced that the only alternatives for addressing the debt crisis are to raise taxes, slash services, or sell off public assets. We have forgotten that there is another option: cut the debt by borrowing from the government’s own bank, which returns its profits to public coffers. Cutting out interest has been shown to reduce the average cost of public projects by about 40%.” Ellen Brown, Public Banking Institute

Interestingly, the federal court found that there was no legal reason for the Public Bank of Canada to not loan governments money. Indeed, they said it was entirely up to the feds to make that decision. Yet here we are a decade later, with our national debt growing at about $76 billion per year and we are still borrowing from private banks and becoming inceasingly indebted to them every day.

I don’t know about you, but it makes me shudder to think that our emergency response to COVID-19 and our economic stimulus package is going to be financed by big banks, most likely foreign. I have to wonder what will happen if our economy gets another huge hit by some “unexpected” event, like climate change, which seems to have taken a back seat in recent weeks. And what happens if we have a global recession and can’t keep up our interest payments?

All of a sudden those crazy conspiracy theories about private banks owning governments don’t seem so ludicrous.

Credit Unions

While the Bank of Canada is a great option for funding public and infrastructure projects, credit unions are the answer for people, small-medium businesses, and building community wealth.

As locally-owned non-profit institutions, credit unions and caisses populaires offer all the same services as a bank. However rather than maximizing profits for faraway shareholders, hiding wealthy corporations and people’s money in offshore accounts, and paying obscene bonuses to their CEOs, credit union goals are actually aimed at providing a higher quality of service to its members, fairer prices, and reinvesting any surpluses back into the communities in which they operate.

Canada already has the highest per-capita credit union membership in the world, with nearly six million people being a member-owner. At the end of 2019, our nation’s credit unions collectively had $246.5 billion in assets, a gain of 6% over the previous year, and an increase in their lending of 5%. For more than a century, they have remained ethical, locally-owned, and fully invested in the communities in which they operate. The research shows they are stable and growing, even without the big corporate tax breaks, shelters and evasion methods used by big banks….and in spite of the huge regulatory barriers they face.

“We face the same regulatory and tax structure as our massive competitors without the economies of scale they have to deal with those challenges.”

Credit unions are not treating fairly by government and they face a number of regulatory disadvantages that tip the scales in favor of big banks and affect their ability to grow.

Following the 2008 global financial crisis, new capital and liquidity rules and reforms were introduced under Basel III (yes, its still going strong) that require banks and credit unions to meet certain minimum capital requirements.

As credit unions tend to be small by banking standards, this creates huge challenges and costs them a great deal of money. According to a recent analysis of the Canadian Credit Union Association (CCUA), smaller Canadian credit unions pay up to a 20% higher effective tax rate than the nation’s big banks.

If this wasn’t bad enough, in 2013 the Harper government eliminated the federal tax benefit for credit unions, which significantly impacted their retained earnings, which is the primary source of capital credit unions use to offer financing.

Unlike big banks, who have a seemingly endless pool of money to loan out (considering they’re just creating it out of thin air), credit unions only have their retained earnings to rely on. The elimination of this tax credit put them at an even further disadvantage and less able to compete with the big banks.

“Bigger institutions have the resources to invest into figuring out how to lower their taxes. And the elimination of the federal tax deduction several years ago resulted in a higher tax burden for credit unions, which means less money left over at the end of the day to invest in the business and return to members. Ultimately, it compromises their sustainability and ability to compete with the large banks.”

Solutions

Once again, the solutions to what seem like very complex issues - rising government debt, compounding interest, increasing control of private and foreign banks over government - are actually not that hard to figure out. Nor are they costly.

We already have a legal institution from which our governments could be borrowing money, interest-free. Restoring the Bank of Canada as a public lending institution could save Canadians billions upon billions of dollars every year. It doesn’t even require changes to legislation, as was recently ruled by our federal court.

And we don’t need to stop there. Provincial governments can adopt public banking models and even municipalities. There are over 700 successful pubic banks around the world that we can learn from and plenty of evidence that they reduce taxpayer costs, increase economic activity, and build local economies.

“Today, no financial institution could survive on the deposit-loan model alone.”

There’s also lots that could also be done to support the growth and development of citizen-owned credit unions and caisses populaires. The Canadian Credit Union Association’s recent “Credit Union Tax Policy Modernization” report offers four recommendations to close the tax gap including the reinstatement of the federal Additional Deduction for Credit Unions that was eliminated by the Harper government in 2013 and resulted in the 10 largest credit unions paying a tax rate 3% - 8% higher than the 6 largest banks. (HUH?!) In addition, unlike big banks, credit unions are regulated provincially so must also pay provincial taxes, creating even more unfairness and imbalance.

In the end, the solutions to our growing national debt are really not that complicated.

Restore the Bank of Canada to its original mandate and borrow future money from it interest-free.

Support the development of other provincial and local public banks and make changes to legislation that create a fairer playing field for credit unions and caisses populaires to keep our money circulating in the communities where it is generated rather than giving it away to big banks and foreign interests.

Neither of these solutions will cost taxpayers any more than they are paying now and are simply a matter of government will.